Do You Really Need More Information?

(Mr. Solheim writes in his individual capacity and does not purport to represent the views of the Norwegian Tax Administration.)

In a previous post, I explained with reference to the Cui 2017 paper on Third Party Information Reporting (TPIR) why I expect good quality TPIR, based on a primitive analysis of the human factor in corporate filings. When I started rereading Cui’s paper, I only read a few lines before a chapter heading from the CIA textbook “The Psychology of Intelligence Analysis” popped into my mind: Do you really need more information? That book contains a full chapter (starting on page 51) on how more information sometimes contributed nothing to the quality of the analysis, but was of immense help for the confidence of the analyst.

I will below make my argument for why the answer should be “yes” when it concerns the TPIR data mentioned by Cui in the paper, but it is a qualified yes. TPIR is a bit like cooking. Fantastic raw materials will not end up as gourmet meals on their own. You need a talented and skilled chef and a kitchen with the right tools, as well.

Having spent some time on capacity-building with less developed tax administrations than the Norwegian, I agree with Cui that establishing a TPIR machinery should not be the first priority in these countries. However, TPIR being the wrong starting point for some developing countries is not an argument for abstaining from it in Norway and other jurisdictions with better-resourced administrations. I will below state my case for why I find TPIR useful based on my observations working for the Norwegian Tax Administration (NTA) (which may of course differ from the opinions of the NTA itself).

My knowledge of U.S. or Canadian use of TPIR is limited, but there is a very fascinating story told in a paper by Keith Fogg about the work of the IRS agent Joe West. It is a story starting with an audit in the late eighties continuing into the nineties and ending with the IRS getting a summons for credit card information linking US taxpayers to bank accounts in the Caribbean. That information eliminated credit cards as an easy means of taxpayer access to evaded funds.

Norway was quick to copy and paste the IRS methodology. First as specific requested information. Then, a few years later, TPIR routines were in place, giving us digitally all the credit card transactions from financial institutions. The information was used in a large audit project identifying Norwegians with undeclared financial wealth in other jurisdictions. It did not take long before it was common knowledge among taxpayers that this modus operandi did not fly anymore. The value of this TPIR as a tool to uncover hidden wealth and income in foreign jurisdictions diminished quickly, as measured in volume of reassessments.

|

| Warning: Do not use for tax evasion |

Calculating the value of TPIR as a mental fence keeping more taxpayers inside the compliance triangle would be a hard nut to crack. I will not even try, but I would be surprised if it was insignificant. The story starting with IRS agent Joe West auditing Dorchester Industries and owner Frank Wheaton Jr. in the eighties, and ending in Norway with a lot of TPIR data with few reassessments illustrates a life cycle. It started with tax authorities going out and collecting specific third-party information needed for cracking cases with serious tax evasion; it was later streamlined as part of the TPIR system; and it ended up as mental fences for tax compliance. Today, that specific TPIR has other analytical uses for the NTA as well.

Calculating the value of TPIR as a mental fence keeping more taxpayers inside the compliance triangle would be a hard nut to crack. I will not even try, but I would be surprised if it was insignificant. The story starting with IRS agent Joe West auditing Dorchester Industries and owner Frank Wheaton Jr. in the eighties, and ending in Norway with a lot of TPIR data with few reassessments illustrates a life cycle. It started with tax authorities going out and collecting specific third-party information needed for cracking cases with serious tax evasion; it was later streamlined as part of the TPIR system; and it ended up as mental fences for tax compliance. Today, that specific TPIR has other analytical uses for the NTA as well.

Almost all the numbers needed for producing a correct tax return for the majority of personal taxpayers in Norway already exist digitally on some third party computer somewhere. The number of sources is much smaller than the number of taxpayers. Having a system of distributing digital numbers from a small number of sources to everyone, having everyone manually punch the same numbers into different kinds of software on their home computers, and then collect all these numbers—with all their typing mistakes—does not make sense to me. It did not make sense in 2010, either. For most Norwegian taxpayers, it has not made sense the last two decades.

The main use of TPIR in Norway today is to prepopulate individuals’ tax returns, which are then made available for the taxpayer for correction and amendments. All of this ensures that we may handle millions of tax returns untouched by humans, including auditing every single entry in most of them. The NTA can do this by relying on recycling of existing data established by the business sector as part of its recording of business transactions. Businesses do it on computers with software designed to handle these exchanges of information. It means that, as a taxpayer, I may go skiing this weekend instead of sitting indoors punching numbers into some tax program on a sunny winter weekend. I love it both as a taxpayer and from nine to five as a tax auditor.

A new deduction wanted by the Norwegian government illustrates why TPIR is the way to go. The government wants personal expenses for toll roads to be deductible from income. There is a logic behind that, but that’s not my focus. The public toll roads are 100% digital and all payments are linked to an identified person. To avoid double deductions, the gross toll road payment must be reduced by the amount each individual has reclaimed from his employer or deducted as business expenses. A large part of these toll payments sits as digital information on the servers of the employers.

The NTA’s way of thinking is that TPIR is our friend. The payments on cars registered to non-business people may be reported as TPIR from a few toll road operators. The correction for reclaimed or already deducted payments may be one more item in the existing TPIR filing from employers on each employee. We do not know at this stage what percentage of all the tax returns we may prepopulate with the correct deduction by using TPIR, but we are aiming very high. Designing the compliance program for this deduction without TPIR is not a tempting alternative.

Establishing the infrastructure needed for TPIR of a specific set of data is the main cost. The exchange itself is comparably very low cost if the software doing the job is well designed and integrated in the data systems of the reporting entities. Ask any tax manager, and they will tell you that tax auditors asking for information that the Enterprise Resource Planning (ERP) software (which manages business processes and accounting) is already programmed to produce is a small burden compared to collecting ad hoc sets of data that the ERP is not programmed to report.

We could do targeted audits, waiting three to five years and launch an identical audit program, collecting the same dataset ad hoc, and then spend a lot of resources on sorting out all the mistakes and non-compliance uncovered by the audits. It does not make sense in 2019 to operate like this. It is much more cost efficient to do the work needed to design the software and needed infrastructure that ensures that there will be a steady flow of good quality TPIR.

The constant expansion of what tax administrations receive as TPIR should also influence the more rational taxpayers. They now know that you never know what the next dataset will be. Would you engage in a toothpaste scheme if you knew that FATCA was two years away? What tax administration veil of ignorance will be the next to fall with the help of TPIR? It gets harder and harder for the taxpayer to rationalize away the risk of future exposure of presently hidden activity.

I will restate that TPIR is a superb ingredient in the hands of a skilled chef in a well-equipped kitchen, but add that you really need a close partnership with your suppliers to make it happen without prohibitive costs.

Yes, we really need more information.

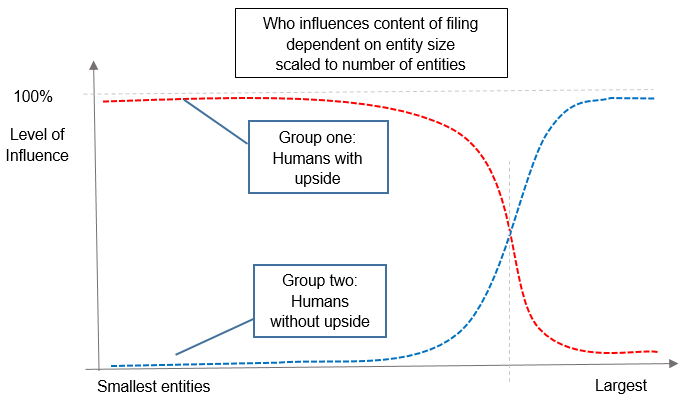

I do not have empirical studies to back up any claim that the balance of influence between the two groups shift at a specific gross income or similar figure. If forced to make a guesstimate, I would, for Norway, say somewhere around USD 5 million, with big variations among business segments. I will, for the sake of simplicity, use USD 5 million as the crossing point.

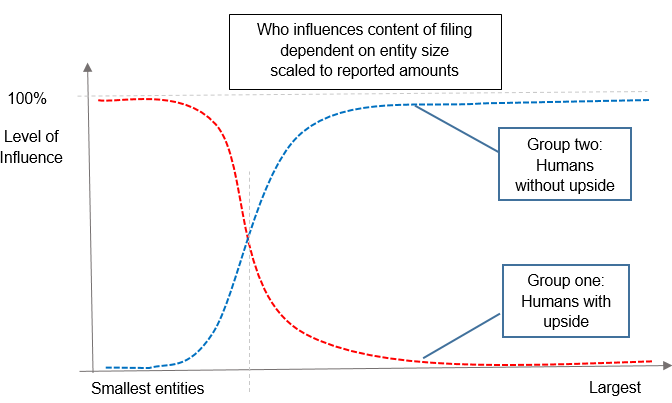

I do not have empirical studies to back up any claim that the balance of influence between the two groups shift at a specific gross income or similar figure. If forced to make a guesstimate, I would, for Norway, say somewhere around USD 5 million, with big variations among business segments. I will, for the sake of simplicity, use USD 5 million as the crossing point. Something very interesting happens to the perspective when we change from entities to dollars: The main bulk of government revenue is collected, reported and paid by the small group of big entities where the people with no upside is in full control over the numbers reported.

Something very interesting happens to the perspective when we change from entities to dollars: The main bulk of government revenue is collected, reported and paid by the small group of big entities where the people with no upside is in full control over the numbers reported.