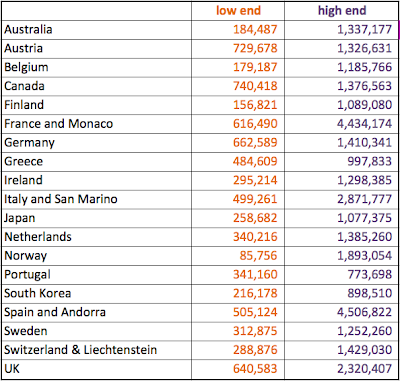

The paper notes the low-end cost is usually for bundlers, while high-end cost is usually for individual donors, and "the greater pay-off attaches to bundled rather than personal contributions." The Center for Public Integrity's story about Bruce Heyman affirms the authors' predictions. Notice in the table above that the low-end price for the ambassadorship to Canada, most associated with the bundlers, is $740,418. From the CPI story:

Chicago-based Bruce Heyman raised more than $750,000 for Obama’s committees since 2007, along with his wife, according to a Center for Public Integrity review of records.From a National Post story on the appointment, Bruce Heyman looks to be happy about the outcome:

- the probability of a political appointment to a posting rises in the attractiveness of the posting as a tourist destination, and as the hardship allowance associated with a posting declines

- appointees that have personal political connections receive more lucrative postings in per capita GDP, tourist volume and hardship allowance terms. They are also more likely to receive postings in Upper Middle Income countries and in the Caribbean, North and Central America.

- The greater the personal or bundled campaign contributions to a presidential campaign, the more lucrative the posting the contributor can expect in terms of per capita GDP, tourist volumes, hardship allowances, and the more likely the posting will be in High Income countries and Western Europe, and the less likely it will be in Central and South Asia or Sub-Saharan Africa.

Notice how the bundlers and political appointees versus the "career diplomats" correspond to the observations above by Fedderke and Jett, and if you review the interactive's details about each of the ambassadors you get further affirmation of Fedderke & Jett's predictions about the costs of obtaining these posts based on their model. Incidentally, from the paper the price of the Court of St. James was "between $650,000 and $2.3 million": according to CPI, that appointment has been confirmed to Matthew Winthrop Barzun, National Finance Chair for Obama's 2012 campaign, who raised at least $1.2 million for the President. Fun fact: the first ambassador to represent the US there was John Adams, who, along with four others to hold that post, later became President themselves, thus completing the cycle. No idea how much each paid to get there, though.

Money might not buy happiness, but it appears that it might well get you to a nice diplomatic post in a tourist destination.