The 4th Annual Tax Policy Colloquium at McGill Law continues Monday with a presentation by Professor Lyne LaTulippe of the Université de Sherbrooke, on a paper entitled "Public consultations framed within a competitiveness discourse." The paper examines the rhetorical and political power of the competitiveness motif in domestic tax policy-making processes, using two specific tax reform episodes in Canada and Australia as case studies of the institutional and political landscape. The author finds that competitiveness in taxation has become a dominant meme, crowding out alternative policy goals and narrowing democratic participation in the process.

The McGill Tax Policy Colloquium features distinguished visiting academics and offers a forum for students, professors, and local practitioners to discuss issues of tax policy and theory, along with related issues of economics and social justice.

Professor LaTulippe's talk is scheduled to commence at 2:30 pm tomorrow; members of the public are warmly welcomed.

Location: McGill Faculty of Law, 3644 Peel Street, New Chancellor Day Hall, Room 203.

Time: Monday, 7 October, 14:30–16:30.

On fiscal policy, politics, society, philosophy, and culture. Follow on twitter: @profchristians

Sunday, October 6, 2013

Sunday, September 29, 2013

Cliff Fleming presenting tomorrow at McGill Law

The 4th Annual Tax Policy Colloquium at McGill Law continues tomorrow with a presentation by Professor Clifton J. Fleming on the topic of the proper taxation of multinationals. The paper, coauthored by Prof. Fleming and Prof. Robert Peroni, is not yet available online but it is entitled Formulary Apportionment in the U.S. International Income Tax System: Putting Lipstick on a Pig? and in it the authors argue that formulary apportionment and the current standard, arm's length transfer pricing, are just two shades of lipstick on the pig that is the US international tax system, with its twin features of deferral and cross-crediting. They conclude that formulary apportionment might be the less offensive shade, but in effect the whole discussion is a diversion from a broad reform that is sorely needed on the pig itself.

The 4th Annual Tax Policy Colloquium at McGill Law continues tomorrow with a presentation by Professor Clifton J. Fleming on the topic of the proper taxation of multinationals. The paper, coauthored by Prof. Fleming and Prof. Robert Peroni, is not yet available online but it is entitled Formulary Apportionment in the U.S. International Income Tax System: Putting Lipstick on a Pig? and in it the authors argue that formulary apportionment and the current standard, arm's length transfer pricing, are just two shades of lipstick on the pig that is the US international tax system, with its twin features of deferral and cross-crediting. They conclude that formulary apportionment might be the less offensive shade, but in effect the whole discussion is a diversion from a broad reform that is sorely needed on the pig itself.The McGill Tax Policy Colloquium features distinguished visiting academics and offers a forum for students, professors, and local practitioners to discuss issues of tax policy and theory, along with related issues of economics and social justice. Professor Fleming's talk is scheduled to commence at 2:30 pm tomorrow; members of the public are warmly welcomed.

Location: McGill Faculty of Law, 3644 Peel Street, New Chancellor Day Hall, Room 203.

Time: Monday, 30 September, 14:30–16:30.

How to Buy a US Ambassadorship, and How Much to Pay

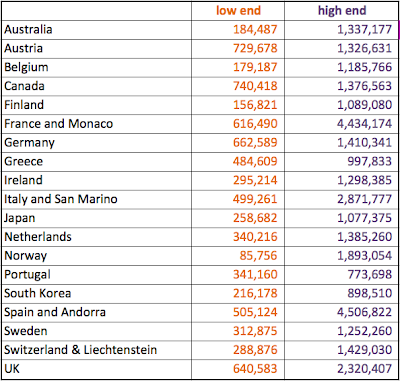

The recent news about the newly appointed US ambassador to Canada, Bruce Heyman--described as "A veteran Goldman Sachs & Co. executive and major fundraiser" for President Obama--reminded me of a paper I read some time ago in which the authors showed that ambassadorships are bought by contributing to the political coffers of the winning presidential candidate. All too unfortunately, this comes as no surprise. The more contributed, the more likely the desired post is obtained. The paper is "What Price the Court of St. James? Political Influences on Ambassadorial Postings of the United States," by Johannes Fedderke and Dennis Jett, and here's a sample of the menu it describes, from a Table called "The Price of Some Lucrative Postings Implied by the Model":

The paper notes the low-end cost is usually for bundlers, while high-end cost is usually for individual donors, and "the greater pay-off attaches to bundled rather than personal contributions." The Center for Public Integrity's story about Bruce Heyman affirms the authors' predictions. Notice in the table above that the low-end price for the ambassadorship to Canada, most associated with the bundlers, is $740,418. From the CPI story:

Related findings from the Fedderke and Jett paper, some of which also affirmed by the latest appointment:

Notice how the bundlers and political appointees versus the "career diplomats" correspond to the observations above by Fedderke and Jett, and if you review the interactive's details about each of the ambassadors you get further affirmation of Fedderke & Jett's predictions about the costs of obtaining these posts based on their model. Incidentally, from the paper the price of the Court of St. James was "between $650,000 and $2.3 million": according to CPI, that appointment has been confirmed to Matthew Winthrop Barzun, National Finance Chair for Obama's 2012 campaign, who raised at least $1.2 million for the President. Fun fact: the first ambassador to represent the US there was John Adams, who, along with four others to hold that post, later became President themselves, thus completing the cycle. No idea how much each paid to get there, though.

Money might not buy happiness, but it appears that it might well get you to a nice diplomatic post in a tourist destination.

The paper notes the low-end cost is usually for bundlers, while high-end cost is usually for individual donors, and "the greater pay-off attaches to bundled rather than personal contributions." The Center for Public Integrity's story about Bruce Heyman affirms the authors' predictions. Notice in the table above that the low-end price for the ambassadorship to Canada, most associated with the bundlers, is $740,418. From the CPI story:

Chicago-based Bruce Heyman raised more than $750,000 for Obama’s committees since 2007, along with his wife, according to a Center for Public Integrity review of records.From a National Post story on the appointment, Bruce Heyman looks to be happy about the outcome:

|

- the probability of a political appointment to a posting rises in the attractiveness of the posting as a tourist destination, and as the hardship allowance associated with a posting declines

- appointees that have personal political connections receive more lucrative postings in per capita GDP, tourist volume and hardship allowance terms. They are also more likely to receive postings in Upper Middle Income countries and in the Caribbean, North and Central America.

- The greater the personal or bundled campaign contributions to a presidential campaign, the more lucrative the posting the contributor can expect in terms of per capita GDP, tourist volumes, hardship allowances, and the more likely the posting will be in High Income countries and Western Europe, and the less likely it will be in Central and South Asia or Sub-Saharan Africa.

Notice how the bundlers and political appointees versus the "career diplomats" correspond to the observations above by Fedderke and Jett, and if you review the interactive's details about each of the ambassadors you get further affirmation of Fedderke & Jett's predictions about the costs of obtaining these posts based on their model. Incidentally, from the paper the price of the Court of St. James was "between $650,000 and $2.3 million": according to CPI, that appointment has been confirmed to Matthew Winthrop Barzun, National Finance Chair for Obama's 2012 campaign, who raised at least $1.2 million for the President. Fun fact: the first ambassador to represent the US there was John Adams, who, along with four others to hold that post, later became President themselves, thus completing the cycle. No idea how much each paid to get there, though.

Money might not buy happiness, but it appears that it might well get you to a nice diplomatic post in a tourist destination.

Labels:

1%,

corruption,

institutions,

lobbying,

politics,

u.s.

Sunday, September 22, 2013

Reuven Avi-Yonah presenting tomorrow at McGill Law

Location: McGill Faculty of Law, 3644 Peel Street, New Chancellor Day Hall, Room 203.

Time: Monday, 23 September, 14:00–16:00.

Thursday, September 19, 2013

Chasing expatriate corporations not going so well, but raising interesting questions of residence

Lee Sheppard has an update in Tax Notes [gated] on the US "anti-inversion" rules--designed to treat corporations that in effect expatriate by reincorporating offshore--as if they were still US persons in some cases.

Reporting on a recent meeting hosted by the International Tax Institute on "Corporate Inversions - Will They Ever End? Is There A Solution?," and featuring John Merrick (Special Counsel to the Associate Chief Counsel (International)); Lew Steinberg (Managing Director - Head of Strategic Advisory, Credit Suisse Securities (USA) LLC); and Willard Taylor (Adjunct Professor, NYU Law School), Lee says the consensus is that:

This kind of expatriation is susceptible to a charge of being done for tax dodging purposes only, and Congress doesn't like it. Accordingly Congress enacted 7874 to throw various obstacles in the way of inversion and, most drastically, to ignore the expatriating attempt all together--i.e., to treat the foreign parent company as a US person--if U.S. shareholders retain 80% ownership. Lee says:

Leaving aside the concentrated center of gravity remark, the 25% test itself is an interesting turn toward formulary apportionment. There has been a lot of discussion in international circles about whether the current standard for allocating revenues among countries based on the arm's length transfer pricing standard, which involves a lot of shenanigans, could be profitably replaced with a more formulaic approach to revenue sharing. As the two papers I linked to yesterday suggest, under formulary apportionment countries would look to assets, employees and sales revenues to devise a formula for allocation among countries. The OECD has in effect rejected even the discussion of formulary apportionment as a policy matter, but I have suggested that I do not think they can suppress this discussion much longer. If we have the US looking at these factors of income production for purposes of determining corporate residence, can formulary apportionment really be so far off the horizon?

Finally, noting that the ownership fraction seems to be the only factor the IRS wishes to consider in analyzing inversions at the moment, Lee states that the priority guidance in this area involves "regulations addressing dilution of shareholdings and manipulation of the ownership fraction. Future regulations will disregard certain shares of the new foreign corporation in determining the U.S. ownership fraction. The government had become aware of transactions designed to minimize U.S. ownership, such as issuance of 21 percent of the new foreign corporation to a friendly investor."

The obvious goal here is to continue to make it harder for US corporations to expatriate, on the theory that expatriation is highly suspect because tax avoidance is a main reason (and some believe the only reason) why a corporation would want to leave the US. This, I think, is consistent with the current US view toward expatriating individuals: their motives are also highly suspect, and so their exit may only be accomplished by means of complex and expensive administrative mechanisms. In the case of individuals, however, expatriation is a final act--once given up, US citizenship will be almost impossible to reacquire. Not so for corporations, at least, so far.

Reporting on a recent meeting hosted by the International Tax Institute on "Corporate Inversions - Will They Ever End? Is There A Solution?," and featuring John Merrick (Special Counsel to the Associate Chief Counsel (International)); Lew Steinberg (Managing Director - Head of Strategic Advisory, Credit Suisse Securities (USA) LLC); and Willard Taylor (Adjunct Professor, NYU Law School), Lee says the consensus is that:

The anti-inversion statute, section 7874, doesn't work very well at its stated goals, and Congress hasn't bothered to fix section 163(j), the ineffectual interest-stripping rule. And there's not a whole lot the IRS can do about it, except treat the departed corporations the same way it treats real foreign parents.For the uninitiated, in an inversion a U.S.-based multinational company restructures its corporate group so that after the transaction the ultimate parent is foreign. After this flip, shareholders of the former U.S. parent company now hold stock of the foreign parent company. Everything else stays the same, e.g. business as usual at the operations level. Here is a nice explanation from Mayer Brown.

This kind of expatriation is susceptible to a charge of being done for tax dodging purposes only, and Congress doesn't like it. Accordingly Congress enacted 7874 to throw various obstacles in the way of inversion and, most drastically, to ignore the expatriating attempt all together--i.e., to treat the foreign parent company as a US person--if U.S. shareholders retain 80% ownership. Lee says:

[N]o one is silly enough to allow them to retain more than 80 percent, in which case the surviving corporation would be re-domesticated. So most recent deals fall in the 75 percent range of retained U.S. ownership, Steinberg explained.

...In June 2012 the IRS issued new proposed ... and temporary regulations... [which] require that the expatriated corporation have at least 25 percent assets, employees, and income in its new country of residence. Merrick admitted that the 25 percent threshold is "a bit on the high side" and "inflexible." The IRS is open to constructive comments but will not return to the easier tests of the 2006 proposed regulations, he said.Lee asks, "Is the third try a charm?" She says practitioners complain that "no company can possibly meet the 25 percent test, particularly the income/sales factor," but:

Merrick demurred. The statute is not designed to allow each U.S. multinational to flee to some other country, he explained. "Our view is that it requires a concentrated center of gravity," he said.Interesting remark: a concentrated center of gravity seems like a qualitative, rather than quantitative, measure, more akin to a mind/management standard for corporate residence than the formalistic place of incorporation rule the US currently uses. Perhaps in time the US will adopt the mind & management rule either in addition to or to replace the current regime. If mind & management plays a replacement role instead of a supplementary one, that opens the door for also considering what individual residence looks like if one employs "a concentrated center of gravity"as the organizing principle. It seems that looks a lot more like the residency tests used by 99% of the rest of the world's countries.

Leaving aside the concentrated center of gravity remark, the 25% test itself is an interesting turn toward formulary apportionment. There has been a lot of discussion in international circles about whether the current standard for allocating revenues among countries based on the arm's length transfer pricing standard, which involves a lot of shenanigans, could be profitably replaced with a more formulaic approach to revenue sharing. As the two papers I linked to yesterday suggest, under formulary apportionment countries would look to assets, employees and sales revenues to devise a formula for allocation among countries. The OECD has in effect rejected even the discussion of formulary apportionment as a policy matter, but I have suggested that I do not think they can suppress this discussion much longer. If we have the US looking at these factors of income production for purposes of determining corporate residence, can formulary apportionment really be so far off the horizon?

Finally, noting that the ownership fraction seems to be the only factor the IRS wishes to consider in analyzing inversions at the moment, Lee states that the priority guidance in this area involves "regulations addressing dilution of shareholdings and manipulation of the ownership fraction. Future regulations will disregard certain shares of the new foreign corporation in determining the U.S. ownership fraction. The government had become aware of transactions designed to minimize U.S. ownership, such as issuance of 21 percent of the new foreign corporation to a friendly investor."

The obvious goal here is to continue to make it harder for US corporations to expatriate, on the theory that expatriation is highly suspect because tax avoidance is a main reason (and some believe the only reason) why a corporation would want to leave the US. This, I think, is consistent with the current US view toward expatriating individuals: their motives are also highly suspect, and so their exit may only be accomplished by means of complex and expensive administrative mechanisms. In the case of individuals, however, expatriation is a final act--once given up, US citizenship will be almost impossible to reacquire. Not so for corporations, at least, so far.

Wednesday, September 18, 2013

Recent Scholarship of Note on Normative and Practical Challenges in Corporate Taxation

Yariv Brauner recently posted "Whither Choice of Entity," in which he examines choice of entity and policy implications in support of the repeal of corporate taxation, or failing that, a redefining of corporate residence to move toward source-based taxation, preferably with formulary apportionment. He provides a comprehensive picture of the ongoing chaos created by entity classification and residence assignment rules. Brauner correctly mourns the lack of normative principles underlying the differential taxation of entities, which he attributes to the "unorganized thinking" that characterizes much of the discussion about how choice of entity rules impact people's business choices, and the general messiness of policy-making as it evolves haphazardly through lobbying and political posturing. He concludes:

In light of the incredible variety of options beyond mere incorporation or non-incorporations, one must wonder why tax law uses corporate or private law as the baseline for the application of its rules. Most importantly, why do we attribute importance to the act of incorporation? ...[T]here is nothing particularly special about businesses that carry a piece of paper stating that they are incorporated. A legal response to that may not be very feasible. We do not have a satisfactory legal answer to the central question: why do we tax corporations separately when only humans bear the burden of such taxation.

...The most obvious lesson is that the potentially negative impact of the corporate income tax on our tax system goes beyond the complexity it imposes on our tax system, and even beyond its negative political implications. In that, it reinforces the conclusion that the first-best step in a reform must include the elimination of the corporate income tax as a firm-level tax, perhaps replacing it with a withholding mechanism to preserve the efficacy of corporations as revenue collecting devices, or with other proxy solutions, such as mark-to-market taxation of public corporations only.

Another solution... may be to replace the current residence based taxation of entities that relies exclusively on corporate personhood with an alternative, more substantive tax regime. This could be an increasingly source-based rather than residence-based tax regime, yet such a reform faces several difficulties, including the need to retain residence as a primary determinant of taxation, the difficulty of identifying the source of income, the difficulty of asserting a fairness-based tax base division between source and residence once established, etc. A better solution would be to adopt formulary taxation that relies on agreement between competing jurisdictions rather than false pseudo-economic notions.Henry Ordower verifies Yariv's concerns and takes a related approach in Preserving the Corporate Tax Base Through TaxTransparency, in which he states:

When, where, and at what rate to tax the income of business entities are the fundamental questions for the corporate income tax. Answers to those questions should remain independent of the taxpayer’s choice of business form, because one may achieve identical revenue outcomes with entity opacity or transparency. When the answers to those questions vary with business form and tax system structure, opportunities to arbitrage those differences across national borders and diminish or avoid tax on the corporate in- come inevitably emerge.

Tax professionals, administrators, academics, economists, and business participants may and often do disagree on whether a corporation’s (or other business entity’s) income from the operation of its business should be taxable to the corporation itself or taxable to its owners. Opinions also may diverge on whether to tax investment income differently from income from the operation of a business. Despite those disagreements, as long as there is to be an income tax, all will agree that the choice of one business form over another should not result in income from business operations escaping income tax completely.

Similarly, income should be subject to tax primarily where the taxpayer produces income from the operation of a business. Taxing income where the taxpayer’s principal office or seat of management happens to be makes sense only under a system that taxes residents and citizens on their worldwide incomes (a global model of taxation like the United States has) and then only secondarily to the place of income production in order to prevent taxpayers from gaining an advantage by placing their income in low-tax jurisdictions.

...[A] wholly transparent income tax system would improve existing corporate tax systems and establish tax neutrality between entities currently subject to the corporate income tax and those that are not. Full transparency is consistent with international treaty obligations and simultaneously eliminates many international tax arbitrage opportunities. Business needs rather than tax benefits would drive choice of business form. If accompanied by a robust system of international apportionment of business income, a fully transparent corporate income tax would eliminate most income allocation arbitrage as well as tax system structure arbitrage opportunities.Read them both to get a good sense of the history, evolution, and ongoing challenges facing corporate income taxation.

Saturday, September 14, 2013

Russell Brand on governance as theatre and why MNCs get all the tax breaks

Russell Brand got invited to the GQ awards, made a joke about Hugo Boss' history serving Nazi troops, and then got ejected. I would never have heard or cared about this except that then Russell Brand decided to write about the experience in the Guardian, and his comments ended up as an indictment of the relationship between elites and government with a nod to the problem of multinational influence on tax policy. Excerpts:

We witness that there is a relationship between government, media and industry that is evident even at this most spurious and superficial level. These three institutions support one another. We know that however cool a media outlet may purport to be, their primary loyalty is to their corporate backers. We know also that you cannot criticise the corporate backers openly without censorship and subsequent manipulation of this information.

Now I'm aware that this was really no big deal; I'm not saying I'm an estuary Che Guevara, it was a daft joke, by a daft comic at a daft event. It makes me wonder though how the relationships and power dynamics I witnessed on this relatively inconsequential context are replicated on a more significant scale.

For example, if you can't criticise Hugo Boss at the GQ awards because they own the event do you think it is significant that energy companies donate to the Tory party? Will that affect government policy? Will the relationships that "politician of the year" Boris Johnson has with City bankers – he took many more meetings with them than public servants in his first term as mayor – influence the way he runs our capital?

Is it any wonder that Amazon, Vodafone and Starbucks avoid paying tax when they enjoy such cosy relationships with members of our government?

Ought we be concerned that our rights to protest are being continually eroded under the guise of enhancing our safety? Is there a relationship between proposed fracking in the UK, new laws that prohibit protest and the relationships between energy companies and our government?From the shallows of celebrity comings and goings, an all-too rare glimpse of perspective on the society we have built for ourselves.

Tuesday, September 10, 2013

Razin on Tax and Migration Competition

Assaf Razin and Efraim Sadka have a new paper up on NBER called Migration into the Welfare State, in which they survey the literature on the tax burden of migration and work with available migration and tax policy data to make some assertions about how taxation impacts inward and outward migration. From the abstract in the paper:

A plea to academic authors who write papers on tax topics especially (and a reminder to myself when I look at my own writing): readers need a clear and succinct summary, written in plain, jargon-free language, to help them summon the desire and the mental energy to work through a paper. The more complex and data-filled the paper, the more a return to Zinsser is to be recommended.

We develop a stylised EU-type model of rich capital-abundant (and productive) countries and poor capital-scarce countries in order to explain a key feature of tax policies and inter- and intra-migration flows. We examine how this model can explain the differences in the tax rates and the generosity of the welfare state, on the one hand, and migration flows, on the other hand, between rich and poor countries, within a union and from the rest of the world. An upward-slopping supply of migrants from outside the union and the relatively low endowment of capital of these migrants gives rise to a fiscal externality.The jargon-heavy style of this abstract continues through the paper and I cannot say that I really understand some of the arguments. Razin and Sadka seem to conclude that under conditions of tax competition (for example, involving migration from countries outside of the EU), rich countries let in too many immigrants, offer them too many social benefits, and levy too high a tax on capital (which immigrants don't typically pay) to pay for it all, while coordination fixes things (although confusingly the papers seems to suggest that coordination brings down capital gains taxes but intensifies migration flows, so I am not sure). Unfortunately this paper requires too much deciphering and parsing work by the reader (an all-too-common phenomenon with academic papers) and at this time of year there is little hope for that.

A plea to academic authors who write papers on tax topics especially (and a reminder to myself when I look at my own writing): readers need a clear and succinct summary, written in plain, jargon-free language, to help them summon the desire and the mental energy to work through a paper. The more complex and data-filled the paper, the more a return to Zinsser is to be recommended.

GAO to IRS: issue guidance on Bitcoin to safeguard tax compliance

Not too long ago, the US Government Accountability Office issued a report entitled "Virtual Economies and Currencies: Additional IRS Guidance Could Reduce Tax Compliance Risks," saying that the extent of tax evasion is unknown but might not be extensive if only virtual currencies stay in a "closed" system, as illustrated by this handy chart:

There you have it. Despite the chart (I'm pretty sure that horse left the barn a long time ago), the report is worth reading to get a sense of the direction of regulatory thinking.

There you have it. Despite the chart (I'm pretty sure that horse left the barn a long time ago), the report is worth reading to get a sense of the direction of regulatory thinking.

Monday, September 9, 2013

McGill Tax Policy Colloquium 2013

This fall marks the fourth installment of the McGill University Faculty of Law Tax Policy Colloquium. This year’s colloquium features a number of distinguished invited speakers who will contribute a rich variety of scholarly works in progress on cutting edge topics involving national and international tax law and policy. If you will be in Montreal on any of these dates, I invite you to join the tax policy class to hear presentations by this illustrious group. All presentations begin at 2:35 in New Chancellor Day Hall, Room 203, at the Faculty of Law, 3644 Rue Peel, Montreal, Quebec.

September 23: Reuven Avi-Yonah

(University of Michigan Law School)

·

Professor Avi-Yonah is the Irwin I.

Cohn Professor of Law and director of the International Tax LL.M. Program at

the University of Michigan Law School, and specializes in corporate and

international taxation. He has served as a consultant to the US Treasury

Department and the Organisation for Economic Co-operation and Development

(OECD) on tax competition, and is a member of the steering group for the OECD’s

International Network for Tax Research.

September 30: J. Clifton Fleming

(BYU J. Reuben Clark Law School)

·

Professor Fleming is the Ernest L.

Wilkinson Chair and professor of law at BYU’s J. Reuben Clark Law School where

he teaches courses on US and international tax law, European Union law, and

public international law. Previously, he has been the Fulbright Distinguished

Chair at the Vienna University of Economics and Business, the Fulbright

visiting professor of law at the University of Nairobi, and the

Professor-in-Residence for the IRS Chief Counsel’s Office.

·

Professor Latulippe currently teaches

in the tax department at the University of Sherbrooke and was previously on the

faculty at UQAM. She researches and publishes on topics of comparative and

international taxation, international tax cooperation, and tax policy.

October 28: Sagit Leviner

(SUNY Buffalo Law School & Ono Academic College Faculty of Law)

·

Professor Leviner is on faculty at SUNY

Buffalo Law School and is also affiliated with Ono Academic College Faculty of

Law in Israel. Her research explores the coming together of normative and

pragmatic aspects of tax policy design, particularly with respect to tax

enforcement, behavioral attributes of taxation, and the tax burden

distribution.

·

Professor Tillotson is a member of the history

department at Dalhousie University. Her research and publications focus on the

cultural history of taxation in Canada, the evolution of the welfare state, and

how gender, class, and social norms affect personal finance.

November 25: Diane Ring

(Boston College Law School)

·

Diane M. Ring is a Professor of Law at

Boston College Law School, where she researches and writes primarily in the

field of international taxation, corporate taxation, and the taxation of

financial instruments. Her recent work addresses issues including cross-border

tax arbitrage, advance pricing agreements, and international tax relations.

Thursday, August 22, 2013

Lavigne & VanRybroek on Language, Communication and Access to Justice

This recently posted article by Michele Lavigne and Gregory VanRybroek, entitled 'He Got in My Face so I Shot Him': How Defendants' Language Impairments Impair Attorney-Client Relationships, while not directly tax-related, presents a very interesting take on what it means to have meaningful access to justice, which is a major aspect of thinking about what it means to say we are governed by the rule of law. I am still more optimistic than PJ about this concept, but I have grave fears for the future of law in the face of the many severe procedural impairments we have been seeing of late. This paper outlines in a deep and rich way some of the fundamental components necessary to a just legal system, but it also just a very well written and fascinating account of the role of language and communication in expressing and implementing law. Abstract:

Language impairments -- deficits in language and the ability to use it -- occur at starkly elevated rates among adolescents and adults charged with and convicted of crimes. These impairments have serious ramifications for the quality of justice. In this article, we focus specifically on the effects of a client's language impairment on the attorney-client relationship, the constitutional realm that suffers most when a client lacks essential communication skills. The effects of language impairment can be seen in a client's ability to work with a lawyer in the first place, tell a story, comprehend legal information, and make a rational and informed decision. This article shows how these effects play themselves out within the attorney-client relationship, and the impact on the lawyer's ability to meet her constitutional and ethical obligations. We also propose concrete steps for improving the quality of communication within the attorney-client relationship. While attorneys will obviously shoulder much of the responsibility, judges and prosecutors are not exempt. A client's poor communication skills are not simply be "the lawyer's problem," but a matter of great concern for all stakeholders in the justice system.

Monday, August 19, 2013

Here is the only reason why Ted Cruz's citizenship is interesting.

It is not whether he's natural born and therefore eligible for the presidency. It is that Ted Cruz has suggested that he did not even realize he might be a Canadian citizen until the Dallas Morning News suggested it to him and asked a few experts on Canadian citizenship law to confirm that Canada, like the US, like many, many countries, confers birthright citizenship on people born in the territory whether they request it, or want it, or not.

This is interesting because this is all happening during America's ongoing roundup of every person on the planet who may be a US citizen because they were born in the US or by birthright through their lineage, for the purpose of imposing draconian penalties for failure to file tax returns and asset information reports under the US citizenship-based tax regime. This is the only tax regime in the world that treats lineage alone as a justification to impose worldwide taxation. Ted Cruz's expressed thoughtlessness about his own dual citizenship, coupled with his breezy intention to simply get rid of the unwanted extra citizenship, beautifully illustrates the major problem with citizenship-based taxation and why no other country on the planet would try to enforce such a system.

The US is right now imposing enormous penalties and unleashing general chaos on people living in other countries with US citizenship, both by newly enforcing long-ignored rules and by layering on top of these rules a new and more draconian layer of enforcement. The chaos comes in the form of fear-inducing, devilishly complicated and duplicative paperwork, and penalties, most of all penalties, and it is being piled on to millions of people around the world, many of whom, like Cruz, are very possibly only beginning to understanding that citizenship status is mostly conferred upon rather than chosen by individuals.

Ted Cruz should consider himself very lucky, because the citizenship he claims he didn't realize he had doesn't carry any punishment for his failure to recognize it. Moreover renouncing, if he really intends to follow through on that promise, will be relatively simple, cheap, and painless other than the cost to his US political career, if any.

Not so if he had lived his life in Canada with his current apparent dual status. US citizens abroad now understand that discovering ties to the US means discovering a world of obligations and consequences flowing from citizenship that you were expected to know and obey. Ignorance of the law being no excuse, the punishments range from the merely ridiculous--many times any tax that would have ever been due--to the infuriating: life savings wiped out and many future tax savings sponsored by your home government, such as in education or health savings plans, treated as offshore trusts and therefore confiscated by the US. Moreover there is no ready escape hatch for the newly discovered and unwanted US citizenship: five years of full tax reporting compliance must be documented, appointments must be made with officials, fees must be remitted, interviews must be conducted, and in some cases exit taxes must be paid. If some in Congress get their way, renunciation could even mean life-time banishment from the US someday soon.

In the grand scheme of things Ted Cruz's citizenship is a non-story. But for what it illustrates about citizenship-based taxation, it could be the story of the century.

This is interesting because this is all happening during America's ongoing roundup of every person on the planet who may be a US citizen because they were born in the US or by birthright through their lineage, for the purpose of imposing draconian penalties for failure to file tax returns and asset information reports under the US citizenship-based tax regime. This is the only tax regime in the world that treats lineage alone as a justification to impose worldwide taxation. Ted Cruz's expressed thoughtlessness about his own dual citizenship, coupled with his breezy intention to simply get rid of the unwanted extra citizenship, beautifully illustrates the major problem with citizenship-based taxation and why no other country on the planet would try to enforce such a system.

The US is right now imposing enormous penalties and unleashing general chaos on people living in other countries with US citizenship, both by newly enforcing long-ignored rules and by layering on top of these rules a new and more draconian layer of enforcement. The chaos comes in the form of fear-inducing, devilishly complicated and duplicative paperwork, and penalties, most of all penalties, and it is being piled on to millions of people around the world, many of whom, like Cruz, are very possibly only beginning to understanding that citizenship status is mostly conferred upon rather than chosen by individuals.

Ted Cruz should consider himself very lucky, because the citizenship he claims he didn't realize he had doesn't carry any punishment for his failure to recognize it. Moreover renouncing, if he really intends to follow through on that promise, will be relatively simple, cheap, and painless other than the cost to his US political career, if any.

Not so if he had lived his life in Canada with his current apparent dual status. US citizens abroad now understand that discovering ties to the US means discovering a world of obligations and consequences flowing from citizenship that you were expected to know and obey. Ignorance of the law being no excuse, the punishments range from the merely ridiculous--many times any tax that would have ever been due--to the infuriating: life savings wiped out and many future tax savings sponsored by your home government, such as in education or health savings plans, treated as offshore trusts and therefore confiscated by the US. Moreover there is no ready escape hatch for the newly discovered and unwanted US citizenship: five years of full tax reporting compliance must be documented, appointments must be made with officials, fees must be remitted, interviews must be conducted, and in some cases exit taxes must be paid. If some in Congress get their way, renunciation could even mean life-time banishment from the US someday soon.

In the grand scheme of things Ted Cruz's citizenship is a non-story. But for what it illustrates about citizenship-based taxation, it could be the story of the century.

Friday, August 16, 2013

Collected Scholarly Work by Ivor Richardson being posted to SSRN

The Victoria University of Wellington SSRN Legal Research Papers has begun to publish the collected scholarly work of the Right Honourable Sir Ivor Richardson, one of the leading tax judges of the late twentieth century. He already has 96 papers posted, and over the rest of 2013, fifty papers are planned, in about ten issues, with more to come in future years. This is a tremendous resource for anyone looking at historical or comparative trends in international and national tax policy development: the most recent issue of the working paper series includes some older articles which are as timely now as they were when first published, for example:

|

Inaugural Address, Victoria University of Wellington, 1967

This paper discusses the growing importance of income tax law, the corresponding increase in tax avoidance, and the different perspectives on tax avoidance. A brief history of income tax is given, and an analysis of the competing objectives of an income tax system, its inherent problems, and the possible solutions to these. There follows an explanation of what is meant by tax avoidance, the features of the New Zealand income tax system which create opportunities for tax avoidance, and the arguments against permitting this on a large scale. The paper then outlines the attitudes towards tax avoidance of the legislature, judiciary, revenue, and taxpayers, before concluding with an observation as to the increased interest which income tax law holds for both lawyers and teachers and students of law.

2 Australian Tax Forum 3, 1985

IVOR RICHARDSON, Victoria University of Wellington - Faculty of Law

Email: richardsons@xtra.co.nz

The subject raises two questions for consideration: the interpretation of tax legislation, and the characterisation of transactions for tax purposes. This paper briefly outlines the problems of drafting tax legislation, before describing the different judicial approaches to interpretation of tax legislation, including the scheme and purpose approach of New Zealand courts. In considering when the scheme and purpose of the legislation will necessitate re-characterisation of transactions for income tax purposes, there is a discussion of the business purpose requirement, and an analysis of the tax effect of the assignment of personal exertion income to a third party. Concerning the manner in which the character of a transaction is to be determined at law, the paper provides a discussion on form and substance, analysing the English ‘fiscal nullity’ approach and its reception in other jurisdictions, and concluding that such an approach must be firmly grounded in the scheme and purpose of the legislation. Much more at Ivor Richardson's SSRN page, linked above. Thanks to Prof. John Prebble for alerting me to this info. |

Tuesday, August 13, 2013

Latest IRS Statistics of Income on Individual Tax Returns

The IRS has issued its latest SOI reports, including the 2011 Individual Income Tax Returns (Publication 1304). These are always interesting. This year's data shows that 145 million individual income tax returns were filed in 2011, about 108M showing a taxable income amount, and 95M showing income tax, for total revenues of just over $1 trillion from the individual income tax. Some highlights:

- salary or wage income: 119M returns, $6T

- unemployment comp: 13M returns, $92B

- social security benefits: 25M returns, $490B

- foreign earned income (i.e. residents of other countries): 445K returns, $28B

- gambling earnings: 1.9M returns, $26B

The IRS also issued 2010 Corporation Research Credit Tables, derived from Form 6765, Credit for Increasing Research Activities, and 2010 Corporation Depreciation Data, derived from Form 4562, Depreciation and Amortization.

Monday, August 12, 2013

How Starbucks Lost its Social License--And Paid £20 Million to Get it Back

I have a new column in Tax Notes International [gated] today, pdf available here, about Starbucks's £20 million promise to the UK after a firestorm of controversy erupted last year when it was revealed to have paid no taxes despite 14 years of franchise expansion in the country.

Abstract:

|

| UK Uncut's logo for Starbucks Protests |

It is well accepted that corporations require various legal licenses to do business in a state. But Starbucks’ recent promise to pay more tax to the UK regardless of its legal obligation to do so confirms that businesses also need what corporate social responsibility experts call a “social license to operate”. Companies may now in effect be required to pay some indeterminable amount of tax in order to safeguard public approval of their ongoing operations. This suggests that even as the OECD moves forward on a project to salvage the international tax system from its tattered, century-old remains, the tax standards articulated by governments will no longer be enough to guarantee safe passage for multinationals. Instead, companies may have to deal with a much more volatile, and fickle, tax policy regime: one developed on the fly by public opinion.As always, I welcome comments.

Tuesday, August 6, 2013

Caterpillar v Comm'r and the Rule of Law in International Tax

James P. Fuller has an interesting summary of the recently-filed Caterpillar case in his latest U.S. Tax Review [gated], in which he laments the competent authority breakdown and argues that the case would have been better off going to treaty-based arbitration, rather than to domestic judicial decision-making channels. I disagree with this conclusion because, given the structure of tax treaty arbitration today, it would--at best--provide a remedy for only one taxpayer at great cost, while the judicial route potentially creates rule of law upon which all can rely. If competent authority arbitration were instead to create a publicly viewable resolution, I could agree with Fuller because what is needed is (1) a multilateral solution to a multilateral problem and (2) a solution with precedent-making force.

Per Fuller:

The competent authority route, which (by being duplicative as in this case) already increases costs for producing the rule of law, would only be exacerbated by arbitration, because Caterpillar's problem would be perfectly preserved for another day, another taxpayer, and another expensive litigation involving multiple parties and governments.

Therein lies the conundrum for international tax law in the current status quo: either we can get taxpayer-specific outcomes but no rule of law (arbitration) or we can get unilateral rule of law but no international resolution (domestic appeals). I am not sure which to prefer, since both are bad for international tax law.

Accordingly, I am glad to see the Caterpillar case go forward in a forum which is open to public view and that, if not settled in the interim, then becomes a part of the body of law, creating more certainty for taxpayers going forward. However, I am unhappy that the forum is unilateral and potentially preserves an unsolvable problem for the taxpayer if the Court agrees with the US position, since France and Belgium will not be consulted in the process and can be expected to continue to disagree with the IRS view of things.

As a result, I can only agree with Fuller that the better route would be bilateral/multilateral decision-making via arbitration if that decision-making is, like internal judicial decision-making, open and accessible to public view.

Per Fuller:

Caterpillar Inc. has petitioned the Tax Court for a redetermination of income tax deficiencies that resulted from the IRS's allocation of royalty income to it from its Belgium and French subsidiaries.

While the case was only recently docketed and has not yet been decided, I thought it worth discussing the case as it results from a breakdown in the competent authority process. It is, of course, the very process that is designed to prevent the consequences faced by Caterpillar. There should be no need for the taxpayer to litigate in one country or the other when treaty relief is an available remedy and the countries involved can settle the issue between themselves.

Following a 1990 reorganization that pushed management power, responsibility, and accountability to subsidiaries such as Caterpillar Belgium and Caterpillar France, the taxpayer entered into amended license agreements with those subsidiaries limiting the maximum royalty in any given year to each subsidiary's net income from the sale of Caterpillar products. Also, if the subsidiary suffered a post-effective-date net operating loss, it would pay no royalty for that year and could carry the loss forward as a negative adjustment to future years' income for purposes of the royalty calculation.

... The IRS ... concluded that the relief-from-royalty provision in the Belgian and French license agreements did not comport with the arm's-length standard under section 482.Fuller points out that there are "several Tax Court cases that permitted related-party license agreement provisions" like Caterpillar's, and as to which the IRS subsequently acquiesced. He goes on to discuss Caterpillar's attempt to obtain competent authority relief, which failed because the French and Belgian tax authorities disagreed with the US position, and US Appeals simply went along with the IRS decision despite these other rulings that would suggest reconsidering the issue, for litigation hazard purposes at minimum:

The Belgian and French tax authorities, having a thorough knowledge of the local operations of the Caterpillar subsidiaries in their respective countries, looked at the same facts that were addressed by the IRS exam team and found that Caterpillar's royalty limitation provision required no adjustment. Caterpillar subsequently had the adjustment reviewed in an IRS Appeals office proceeding. The IRS Appeals officer simply accepted the IRS exam team's economist's report.

...it appears from Caterpillar's Tax Court petition that the IRS exam team's economist simply used that agreement as grounds for asserting that such a relief-from-royalties' provision is inappropriate, and not at arm's length.Fuller notes the dual-bureaucracy created by two simultaneous review procedures, i.e., competent authority and internal appeals, and concludes that binding arbitration of the competent authority procedure, rather than resort to the US judiciary, would have been the better approach:

If the two countries' competent authority negotiators cannot reach an agreement, then there should be some form of compelled arbitration to bring about an agreement. Otherwise, the taxpayer is stuck in the middle. A taxpayer should not have to litigate its case in one country or the other (or both) simply because the U.S. competent authority negotiators could not reach an agreement with the foreign country's competent authority negotiators. This is especially true in a situation such as that faced by Caterpillar: The Tax Court has already held that such provisions are appropriate in related-party license agreements.I appreciate Fuller's argument about the taxpayer's bind, but as I have noted before, if the case went the way of binding arbitration, in the long run the issue could potentially never be settled, since the decision in arbitration would be completely confidential and therefore not accessible or applicable to other taxpayers. That makes international tax dispute resolution much more expensive than it has to be, all because the powers that be have prioritized absolute taxpayer confidentiality over the rule of law. I think that is a miserable trade-off as well as being an unnecessary one: as this case shows, the taxpayer is willing to sacrifice some measure of its own confidentiality in order to get resolution in domestic law, so it is not clear why international law should be so different. (The arguments for difference are weak--see my analysis in the link above.)

The competent authority route, which (by being duplicative as in this case) already increases costs for producing the rule of law, would only be exacerbated by arbitration, because Caterpillar's problem would be perfectly preserved for another day, another taxpayer, and another expensive litigation involving multiple parties and governments.

Therein lies the conundrum for international tax law in the current status quo: either we can get taxpayer-specific outcomes but no rule of law (arbitration) or we can get unilateral rule of law but no international resolution (domestic appeals). I am not sure which to prefer, since both are bad for international tax law.

Accordingly, I am glad to see the Caterpillar case go forward in a forum which is open to public view and that, if not settled in the interim, then becomes a part of the body of law, creating more certainty for taxpayers going forward. However, I am unhappy that the forum is unilateral and potentially preserves an unsolvable problem for the taxpayer if the Court agrees with the US position, since France and Belgium will not be consulted in the process and can be expected to continue to disagree with the IRS view of things.

As a result, I can only agree with Fuller that the better route would be bilateral/multilateral decision-making via arbitration if that decision-making is, like internal judicial decision-making, open and accessible to public view.

Wednesday, July 24, 2013

What the banks’ three-year war on Dodd-Frank looks like

A fascinating account from the Sunlight Foundation of the gutting of a regulatory initiative by the kind of methodical persistence that can only be sustained by special interest groups with much to be gained from weak regulation:

Here's a chart depicting meetings by sector over time:

From the discussion:

Sunlight catalogues the delays and dismantling of Dodd Frank that has been accomplished by all this lobbying and litigating and concludes:

In the three years since President Barack Obama signed the Dodd–Frank Wall Street Reform and Consumer Protection Act, federal regulators charged with implementing it have opened their doors to the biggest banks over and over again – 14 times as frequently as they have to representatives of consumer and pro-financial reform groups, a new Sunlight Foundation analysis finds.

By most accounts, the banks’ besiege-the-regulators strategy has yielded rich rewards in sapping, slowing, and stymieing regulations intended to prevent another massive financial crisis. The emerging consensus is that Dodd-Frank implementation is limping, while the big banks are poised to return to being the most profitable industry in the U.S.The website feature an interactive showing the number of meetings by sector over the three years; you can mouse over the dots to see their identities. Is it any surprise that the Giant Vampire Squid is at the top with a whopping 222 meetings, followed closely by JP Morgan with 207? Each of these giants independently dwarfs the entire "pro-reform" group, that tiny cluster of dots on the other end of the graph.

Here's a chart depicting meetings by sector over time:

From the discussion:

In the 152 weeks our data cover, we find 59 weeks in which regulators met with financial sector representatives at least once every single day (Monday through Friday), and 47 weeks in which they met with financial sector representatives at least four times.

... By contrast, active pro-reform groups appeared in only 153 meetings logs – only about one meeting for every 14 regulators held with financial institutions and associations. Moreover, 24.2 percent of pro-reform group meetings took place on a single issue: the Consumer Financial Protection Bureau.

...Law and lobbying firms, largely working in service of financial institutions, appeared in 707 meetings. Other, non-financial corporate interests, largely energy and agricultural companies, participated in 381 meetings. These companies are major purchasers of derivative contracts, which they use to hedge against price risk.Imagine you're a regulator. 3,000 meetings with finance industry lobbyists, lawyers, and other corporate interests over three years, each one doing their best to explain why you should undermine the law as written in some tiny way. Would you not want to tear your hair out? Quit in despair? Or just give in to the soothing balm of lobbyist favor? What could possibly be left of the law after this barrage? Meanwhile the anti-regulation crowd has worked very diligently to kill Dodd-Frank's provisions in other ways, such as the lawsuit against the corporate tax transparency provisions sponsored by the American Petroleum Institute.

Sunlight catalogues the delays and dismantling of Dodd Frank that has been accomplished by all this lobbying and litigating and concludes:

...Collectively, the data offer a powerful testament to the oldest and still perhaps most effective technique in the lobbyist’s playbook: sheer persistence. As the Dodd-Frank law passes its third anniversary, lagging on deadlines, and increasingly defanged, the meetings log data offer a compelling reason why: the banks have overwhelmed the regulators.Lobbying pays, and it pays whether it is done before, during, or after legislation has been passed. This represents a major governance crisis with no redress anywhere to be found.

Taxcast on unilateral and multilateral approaches to the problem of base erosion

I contributed to this month's Tackle Tax Haven's podcast, together with the very interesting Krishen Mehta, formerly of PWC and now of Asia Initiatives where he works on tax policy issues. This month's topics included the OECD's report on the base erosion project and what countries can do unilaterally while they are waiting (potentially for a very long time) for multilateral change. Have a listen.

Thursday, July 18, 2013

Quebec's governance crisis continues: mayor who resigned under fraud charge gets $267K severance

There is something seriously broken in a governance system that produces this result, as reported by the CBC:

The City of Montreal has confirmed that former mayor Michael Applebaum has received more than $267,000 in severance pay.

Applebaum resigned from office after being arrested in June on 14 charges including fraud and conspiracy.

City spokesman Gonzalo Nunez said the law governing severance payouts does not take into account the reason for the end of time in office, except in the case of death.Mr. Applebaum and Mr. Tremblay should both disgorge their severance pay of course, and while they are at it, why not all the pay they have ever received from the taxpayers of Quebec, in restitution for abuse of office. But that's not what the law requires. More evidence that we are experiencing a serious governance crisis in Quebec.

Wednesday, July 17, 2013

TJN on the rule of law and the forthcoming OECD report on base-erosion

The OECD is expected to release its plan to implement its anti-base-erosion project this Friday, and the Tax Justice Network has issued a pre-emptive strike as it were, predicting that the OECD will do very little by way of fundamental reform. Instead, TJN predicts a patchwork of half-hearted measures that will be delivered through the toothless mechanism of non-binding recommendations, instead of a full-throated commitment to real change, which the TJN says would require endorsement of combined reporting & formulary apportionment for multinational companies. I am still not convinced combined reporting is a panacea, but I understand TJN's perspective that arms' length reporting probably isn't capable of delivering the result they seek with respect to taxing the profits of multinationals on a global basis. You can read TJN's whole report here.

But I wanted to note something that particularly struck me in this report, an issue that I worked through at length not too long ago and that has been bothering me for quite a while, and that is the recognition that for the international tax law system to work, we desperately need more transparency regarding what lawmakers actually do when it comes to international tax compliance. Here is what I said on the subject in an article called How Nations Share:

The OECD has exploited this gap to its own institutional advantage, by making itself a norm aggregator and filtering mechanism. It thus deliberately creates a non-legal alternative to direct access to legal decision-making. This is a major, even if not well-understood, impediment to the development of law in taxation that has serious consequences precisely because it shields from public scrutiny just how much base erosion is actually going on. We (the public) simply cannot know how big the base erosion problem really is because we cannot access the competent authority decisions that in fact allocate income internationally. The OECD presumably knows the answer but suits its own political and institutional purposes by publishing a highly-processed version of events in the form of reports, guidance, etc.

Because I view this as a major problem for the rule of law which is made ever more serious by being ignored as an issue altogether, I was very gratified to see TJN pick up on the theme and call for publication of competent authority decision-making:

But I wanted to note something that particularly struck me in this report, an issue that I worked through at length not too long ago and that has been bothering me for quite a while, and that is the recognition that for the international tax law system to work, we desperately need more transparency regarding what lawmakers actually do when it comes to international tax compliance. Here is what I said on the subject in an article called How Nations Share:

In the case of international income, it is [tax] disputes and their resolutions, and not the law on the books, that constitute the international tax regime. Yet it is all but impossible for citizens to observe exactly how, or how well, their governments navigate this aspect of economic globalization. [Tax treaties] provide only a design for allocating international income among nation states. It is the application of these agreements that determines how revenues are allocated in practice. This application has taken place over the years through hundreds of thousands of interpretive decisions, the vast majority of which are not accessible to the public. Instead, international tax disputes are mostly delegated to institutions that resolve issues in informal, “non-law” ways with minimal public access to the decision-making process and its outcomes. As a result, international tax law in practice features little or no “law.”In the article, I explained that when actual decisions about the taxation of multinationals are made through processes that lack judicial oversight and feature no public access whatsoever, this creates a huge knowledge gap between the law as written (in legislation and in treaties among other documents) and the law in action (after the competent authorities make their decisions).

The OECD has exploited this gap to its own institutional advantage, by making itself a norm aggregator and filtering mechanism. It thus deliberately creates a non-legal alternative to direct access to legal decision-making. This is a major, even if not well-understood, impediment to the development of law in taxation that has serious consequences precisely because it shields from public scrutiny just how much base erosion is actually going on. We (the public) simply cannot know how big the base erosion problem really is because we cannot access the competent authority decisions that in fact allocate income internationally. The OECD presumably knows the answer but suits its own political and institutional purposes by publishing a highly-processed version of events in the form of reports, guidance, etc.

Because I view this as a major problem for the rule of law which is made ever more serious by being ignored as an issue altogether, I was very gratified to see TJN pick up on the theme and call for publication of competent authority decision-making:

Currently, the MAP [competent authority dispute resolution process] is very secretive, and decisions often involving hundreds of millions or even billions of dollars are not published. The secrecy of both MAP processes and APAs greatly increases the power of frequent actors in these processes, i.e. the international tax and accounting firms – to the great detriment of the system as a whole. Publication of both would be a great step towards a system which could both provide and more importantly be seen to deliver a fair international allocation of tax.TJN's worries about the repeat-player advantage gained by tax and accounting professionals are well-founded, but I think what is most clearly articulated here is that this is fundamentally a rule of law matter. Moreover, TJN puts this issue third in line in terms of reform priorities but I actually think it is much closer to being at the top of the heap in terms of structures that cause intractable problems for international taxation. I will be very interested to see how the continued pressure TJN has been able to place on OECD decision-making to date plays out on this particular issue.

Subscribe to:

Posts (Atom)