On fiscal policy, politics, society, philosophy, and culture. Follow on twitter: @profchristians

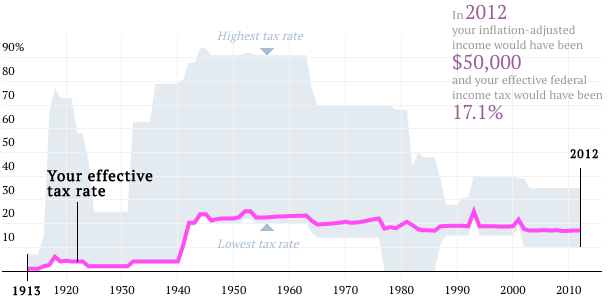

Having not been alive in the '50s or '60s, let alone filing taxes, I was struck by the high top income tax rate—exactly double the highest tax rate today. It made me wonder: what would my income tax be if I had earned the equivalent of what I earn now several decades ago—or even in 1913, when the current federal income tax program was first introduced? What would the history of income taxes look like through the collective eyes of people in my exact financial situation over the past 100 years?Neat! Also, a very fast and easy way to discount a present dollar amount back 100 years.

One initial thought is wasn't back in those days despite the higher rates far more egregious tax shelters and loopholes. In Canada for example there was no capital gains tax until the early 1970s. There were sucession duties/estate tax. Of course few people actually had a lot of capital gains especially if you go way back to the 1940s.

ReplyDeleteIn the US you didn't have subpart F prior to 1962 and my rough understand is the treatment of foreign trusts and things of that nature was far more generous. I also think there were more states without any income tax back in those days in the US too.